Global Solutions For Business

Linking Expertise and Resources

Diverse and Extensive Market Reach

Since 1998, Presidio Ventures has been Sumitomo Corporation of Americas’ eyes and ears within Silicon Valley’s unique ecosystem. Acting as the company’s venture capital arm, Presidio has invested in more than 200 companies over the past twenty years and continues to evaluate next-generation business models and technologies for the rapidly changing startup landscape.

Keeping up with industry trends is hard enough, but being able to see ahead – to anticipate future trends - is a real talent. The team at Presidio draws upon their experience as well as the market knowledge they have being tapped into Sumitomo’s vast business network to identify companies that show promising solutions for today’s (or tomorrow’s) most pressing issues and opportunities.

Some of these opportunities are taking place in the pseudo-reality platforms of the metaverse. In fact, some of the largest art deals made this year have taken place here. According to Financial Times, $41 billion has been spent on NFTs to date, making the market for digital artwork and collectibles almost as valuable as the global art market. As the market grows and matures, NFTs are being used as “utilities” for companies and projects to provide customers with rights to participate in physical events, access to metaverse festivals, receive priority to purchase upcoming merchandise, tokens and NFTs, and much more. NFTs are traded in marketplaces such as OpenSea, used in games and metaverses such as Crypto Kitties and Sandbox respectively.

Some of these opportunities are taking place in the pseudo-reality platforms of the metaverse. In fact, some of the largest art deals made this year have taken place here. According to Financial Times, $41 billion has been spent on NFTs to date, making the market for digital artwork and collectibles almost as valuable as the global art market. As the market grows and matures, NFTs are being used as “utilities” for companies and projects to provide customers with rights to participate in physical events, access to metaverse festivals, receive priority to purchase upcoming merchandise, tokens and NFTs, and much more. NFTs are traded in marketplaces such as OpenSea, used in games and metaverses such as Crypto Kitties and Sandbox respectively.

Presidio has joined a bridge round for Web3 Pro, Inc. (“Web3 Pro”), a white-label enterprise Non Fungible Token (NFT) platform company headquartered in Palo Alto, CA. Web3 Pro will use the funds from this round to continue expansion of its global team, build a next generation enterprise-grade suite of software in the NFT and Web3 area, and enter into numerous industry verticals including entertainment & music and sports.

Presidio has joined a bridge round for Web3 Pro, Inc. (“Web3 Pro”), a white-label enterprise Non Fungible Token (NFT) platform company headquartered in Palo Alto, CA. Web3 Pro will use the funds from this round to continue expansion of its global team, build a next generation enterprise-grade suite of software in the NFT and Web3 area, and enter into numerous industry verticals including entertainment & music and sports.

“We’re excited to enter into the Web3 world and expand our media and entertainment business horizon through our investment into Web3 Pro,” said Mr. Doug Kuribayashi, CEO of Presidio Ventures. “We believe that Sumitomo Corporation’s expertise and significant experience in the media, entertainment, digital and commerce business, together with its widespread customer base in consumer business will add value to Web3 Pro in the future.”

The term “Web3’’ is an idea for a new iteration of the World Wide Web based on block chain technology, which incorporates concepts such as decentralization and token-based economics. Serving as SCOA’s venture capital arm, Presidio Ventures anticipates myriad opportunities to help scale and apply Web3 Pro’s unique solution throughout the company’s vast business network. Web3 Pro’s technology has the potential for enterprise-level customers to evolve their Web2.0 websites and business into emerging Web3 enabled ones using NFTs as a utility so that they can attract younger generation customers in this post-COVID digitized world.

“We are excited to bring on Presidio Ventures as an investor and supporter of our expanding platform,” said Christian Ferri, CEO and Founder of Web3 Pro as well as a block chain pioneer and author on the subject of NFTs. “With their resources and access to Sumitomo’s global network, we are confident we can continue to scale our company and enter into new markets, providing a unique offering across various industries.”

The term “Web3’’ is an idea for a new iteration of the World Wide Web based on block chain technology, which incorporates concepts such as decentralization and token-based economics.

SINAI is a San Francisco based tech company focused on automating how companies monitor, price, analyze risk and reduce carbon emissions worldwide. Building a company’s carbon inventory by collecting primary data from the company allows calculation of the company’s carbon footprint. SINAI’s software can organize the inventory at a granular level, from corporate, business unit, facilities, processes, to activity.

SINAI is a San Francisco based tech company focused on automating how companies monitor, price, analyze risk and reduce carbon emissions worldwide. Building a company’s carbon inventory by collecting primary data from the company allows calculation of the company’s carbon footprint. SINAI’s software can organize the inventory at a granular level, from corporate, business unit, facilities, processes, to activity.

“This is important, as building a carbon inventory for reporting purposes is very different from building an inventory for decarbonization,” said Tim Kazurayama of Presidio Ventures. “Take for example, diesel; In reporting, you can just calculate the company’s total diesel emissions and report it. For decarbonization, it’s important to collect the different sources of diesel (ex: cars, buses, blast furnaces) to link it to specific decarbonization strategies. Following building the inventory is building a baseline scenario. Here, we are creating projections of what your company’s emission footprint will be like if it’s operating a business on a traditional pathway, or not making any changes to operations.”

SINAI uses the data from the inventories and baseline scenarios to create mitigation options or projects combining financial and environmental data. Using a MACC curve, you can identify and compare different options and prioritize projects based on cost effectiveness and abatement potential.

“From data collection, system configuration, implementation and training to ongoing support, we have a dedicated team committed to ensuring every customer is successful at achieving the goals they set out to achieve in using our solutions,” said Kazurayama. “We’ve had customers report back to us that our level of customer service is a true differentiating factor for SINAI.”

“Late last year, SINAI announced the results of a multi-company collaboration in the agricultural industry where companies partnered and used SINAI’s platform to identify CO2 emissions across the supply chain. This partnership allowed for the collection, calculation, forecasting and secure sharing of primary emissions data across this global supply chain to drive industry mitigation and decarbonization efforts forward. This project included connecting and allocating emissions all the way from seed processing to agricultural production, trading, logistics, feed & food production and operation, and finally, distribution from Brazil to global markets using the SINAI platform.”

SINAI has just completed the 1st phase of the collaboration and has the results, but has not announced yet.

SINAI uses the data from the inventories and baseline scenarios to create mitigation options or projects combining financial and environmental data. Using a MACC curve, you can identify and compare different options and prioritize projects based on cost effectiveness and abatement potential.

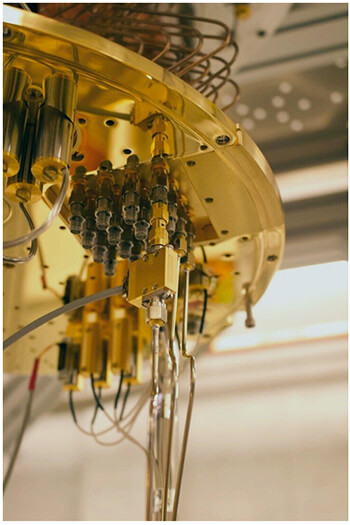

Another fascinating investment that Presidio recently funded is with Quebec, Canada-based Nord Quantique, a company that is quite simply looking to create computers that don’t make errors. Nord Quantique (NQ), founded by Julien Camirand Lemyre and Philippe St-Jean in 2020, emerged from the Institut quantique of Université de Sherbrooke, and currently develops all the components of an error-correcting processor for quantum computers. The company develops quantum hardware for fault-tolerant quantum computing, redesigning processors from the ground up with low-error in mind. This means creating superconducting circuits that can mitigate errors on every individual qubit, providing a faster pathway to fault tolerance at scale.

Another fascinating investment that Presidio recently funded is with Quebec, Canada-based Nord Quantique, a company that is quite simply looking to create computers that don’t make errors. Nord Quantique (NQ), founded by Julien Camirand Lemyre and Philippe St-Jean in 2020, emerged from the Institut quantique of Université de Sherbrooke, and currently develops all the components of an error-correcting processor for quantum computers. The company develops quantum hardware for fault-tolerant quantum computing, redesigning processors from the ground up with low-error in mind. This means creating superconducting circuits that can mitigate errors on every individual qubit, providing a faster pathway to fault tolerance at scale.

Located in the vibrant quantum ecosystem of Sherbrooke, Quebec, Canada, NQ can leverage its renowned scientific excellence, matched by its broad technology development expertise, and paired with access to infrastructure that covers all needs, from quantum science to industrial-scale microfabrication.

Located in the vibrant quantum ecosystem of Sherbrooke, Quebec, Canada, NQ can leverage its renowned scientific excellence, matched by its broad technology development expertise, and paired with access to infrastructure that covers all needs, from quantum science to industrial-scale microfabrication.

The company develops quantum hardware for fault-tolerant quantum computing, redesigning processors from the ground up with low-error in mind. This means creating superconducting circuits that can mitigate errors on every individual qubit, providing a faster pathway to fault tolerance at scale.

Living large with a smaller footprint is the mindset behind another Presidio Ventures investment: Ori. Founded in 2015 Ori is a space transformation company. Launched out of the MIT Media Lab in order to respond to the challenges of urban density, Ori robotics transform spaces and seamlessly facilitate a more sustainable, flexible, affordable and desirable way to develop real estate and live. In other words, Ori has developed “expandable apartments” that are dynamic spaces. Their walls move. Rooms appear and disappear on command, so you get far more than what you see. It’s real estate that lets you live where you want, without sacrificing the space you need.

Also backed by SidewalkLabs (an Alphabet company) and the likes of Ikea, Geolo, and Khosla Ventures, Ori looks to tackle a big, complex problem, but we are an intrepid group with shared values focused on a mission to vastly improve urban living both in terms of experience and affordability. Adopters can even retrofit your residential project by offering new unit types with zero construction complexity or changes to building systems.

Also backed by SidewalkLabs (an Alphabet company) and the likes of Ikea, Geolo, and Khosla Ventures, Ori looks to tackle a big, complex problem, but we are an intrepid group with shared values focused on a mission to vastly improve urban living both in terms of experience and affordability. Adopters can even retrofit your residential project by offering new unit types with zero construction complexity or changes to building systems.

Ori robotics transform spaces and seamlessly facilitate a more sustainable, flexible, affordable and desirable way to develop real estate and live.